Flights get canceled. Luggage goes missing. People get sick. When these things happen abroad, they can turn into nightmares…

A good travel insurance policy acts like a safety net. It’ll stop bad things from ruining your trip and your budget. Whether you’re heading to Shanghai, Tokyo, or Bali, the right coverage gives you peace of mind.

Let’s break down everything you need to know about travel insurance to travel smarter and safer!

What Does Travel Insurance Cover on Trip.com?

Credit: from Robert Bye, Unsplash | People waiting for their flights

Travel insurance isn’t just about making amends for your canceled flights. It’s a safety net for the unpredictable. Here’s how it can rescue your trip:

Coverages | Features |

Medical Emergencies | Cover for medical expenses incurred while traveling, including doctor visits, hospital stays, and emergency medical evacuation. |

Free Trip Cancellation | Reimbursement for non-refundable trip costs if your trip is cancelled or cut short due to a covered reason, such as illness, severe weather, or a death in the family. |

Lost/Stolen Luggage | Reimbursement for the cost of lost, stolen, or damaged luggage, lost passport, and personal belongings. |

Travel Delay | Reimbursement for additional expenses, such as meals and lodging, in the event of a covered travel delay. |

Emergency Assistance | Access to 24-hour emergency assistance services, such as emergency medical and travel assistance, emergency cash transfers, and legal and travel referrals. |

Flight Accident | Coverage for death or dismemberment in the event of a covered air travel accident. |

How to Choose the Best Travel Insurance Policy on Trip.com?

Selecting a satisfying travel insurance on Trip.com depends on your destination, health, and trip activities. Follow these steps to find the perfect coverage:

Step 1: Assess Your Needs

Consider purchasing travel insurance if you encounter a high-risk destination, expensive healthcare, adventure sports, multi-flight bookings, or non-refundable expenses.

Step 2: Key Benefits Table

Travel insurance isn’t just about “having it”, but also whether it’ll save you when disaster strikes.

Key Benefits | Best for |

Medical Expenses | Seniors, chronic illness |

Trip Cancellation | Expensive pre-booked trips |

Baggage Delay/Loss | Photographers, frequent flyers |

Step 3: Choose the Best Type for You

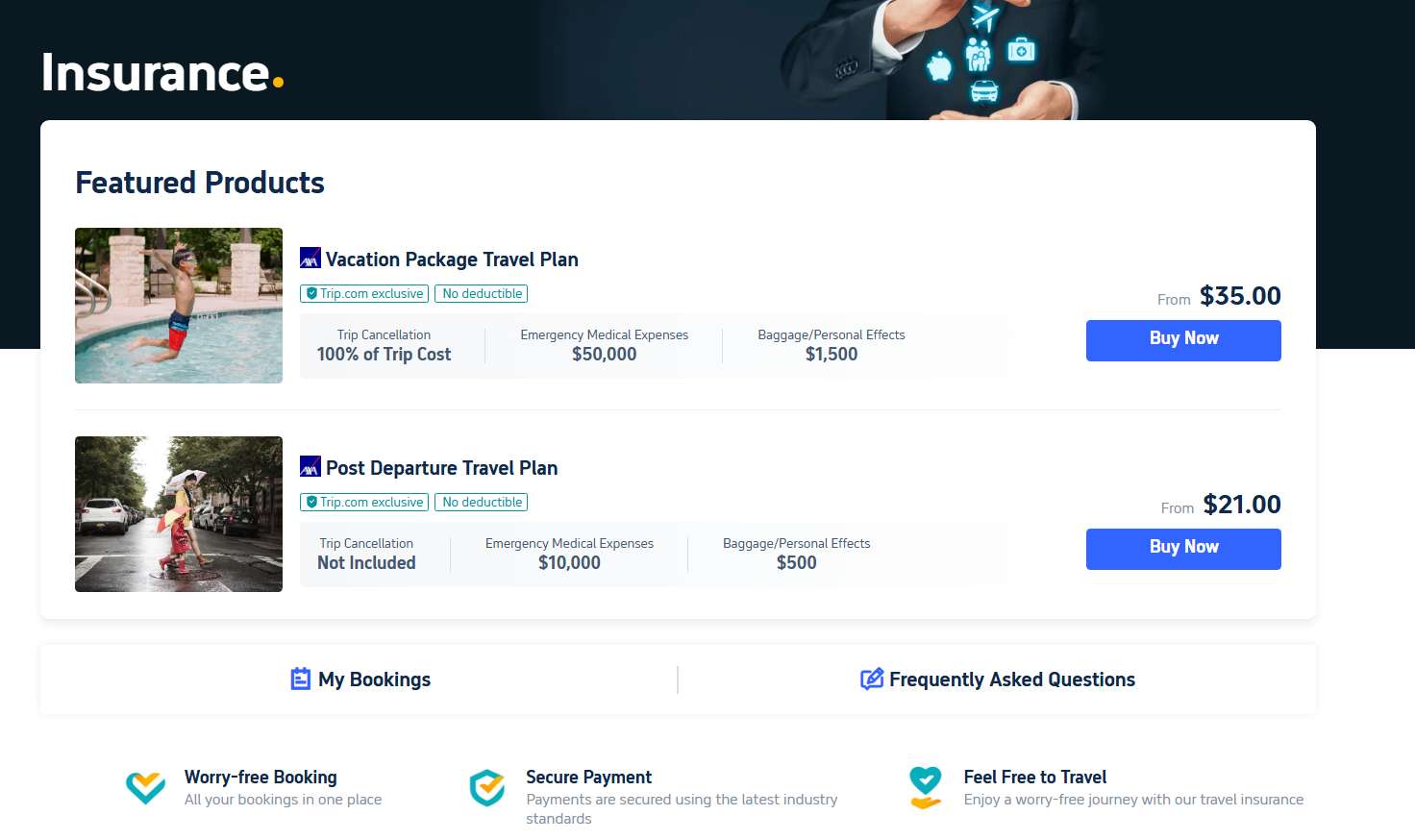

Trip.com offers 2 main types of travel insurance for US travelers: “Vacation Travel Plan” and “Post Departure Travel Plan”.

The Best Travel Insurance Plan | Vacation Travel Plan

Check out the following key coverages of "Vacation Travel Plan" on Trip.com.

Coverages | Maximum Benefit (Per Person Per Trip) |

Trip Cancellation | 100% of Trip Cost |

Trip Delay | $2000 |

Accidental Death/Dismemberment | $10,000 |

Emergency Accident & Sickness Medical Expense | $50,000 |

Baggage/Personal Effects | $1,500 |

Baggage Delay | $500 |

The Best Travel Insurance Plan | Post Departure Travel Plan

Check out the other cheaper plan called "Post Departure Travel Plan" in detail:

Coverages | Maximum Benefit (Per Person Per Trip) |

Trip Interruption | 100% of Trip Cost |

Trip Delay | $500 |

Emergency Accident & Sickness Medical Expense | $10,000 |

Baggage/Personal Effects | $500 |

Baggage Delay | $500 |

Note: Check if your travel insurance explicitly covers pre-existing conditions or acute onset episodes, and declare your medical history when purchasing.

When Travel Insurance Is a Must?

Credit: from Alex Azabache, Unsplash | Nusa Penida, Bali, Indonesia

Not every traveler needs to buy travel insurance, but if any of these apply to you, it’s worth considering:

- If You’re Visiting Multiple Countries

Have you already decided on backpacking through Southeast Asia (such as Bali, Thailand, and Singapore)? The more destinations you plan to visit, the higher the chance that something goes wrong… A single travel insurance policy can easily cover you across borders.

- If You’re Engaging in Adventure Activities

Check exclusions carefully. If injuries occur during unapproved activities, the claims will be denied.

- If You’re Travelling during Peak or Risky Seasons

Frequent flight/ferry cancellations will happen due to storms and floods caused by heavy rain. A proper travel insurance can cover you for extra costs if monsoons strand you, like unplanned hotel stays.

When You Might Skip Travel Insurance?

In fact, travel insurance isn’t always necessary. You can risk going without if your trip is short, domestic (like a weekend in Las Vegas), or you’re okay with small losses (like a cheap hotel cancellation fee).

But for international trips, especially to places with expensive healthcare (Europe) or complex travel logistics (visa rules/tech controls). So, it’s still worth the small cost for travel insurance!

Tip: Only rooms labeled “Free Cancellation” on Trip.com can be canceled without fees; cancel before the specified deadline

FAQs about Travel Insurance

Do I need travel insurance?

It’s highly recommended for unexpected issues like medical emergencies, trip cancellations, or lost luggage.Why purchase travel insurance?

To cover risks like medical costs, trip interruptions, lost belongings, or emergencies abroad.Is travel insurance mandatory?

Some countries require it for visas, but most trips don’t mandate it.Can I add travel insurance after booking?

Yes, but do it before departures; some benefits (like cancellation) may have time limits.

897 booked

897 booked